vermont state tax form

Incentive amounts are listed in Table 1 according to the filing status of the purchaser Adjusted Gross Income and. The vehicle must be registered in the State of Vermont.

Tax Year 2021 Personal Income Tax Forms Department Of Taxes

Line f HOUSEHOLD INCOME - Interest on US state or municipal obligations Enter the income reported on federal Form 1040 and all interest income from federal state or municipal government bonds.

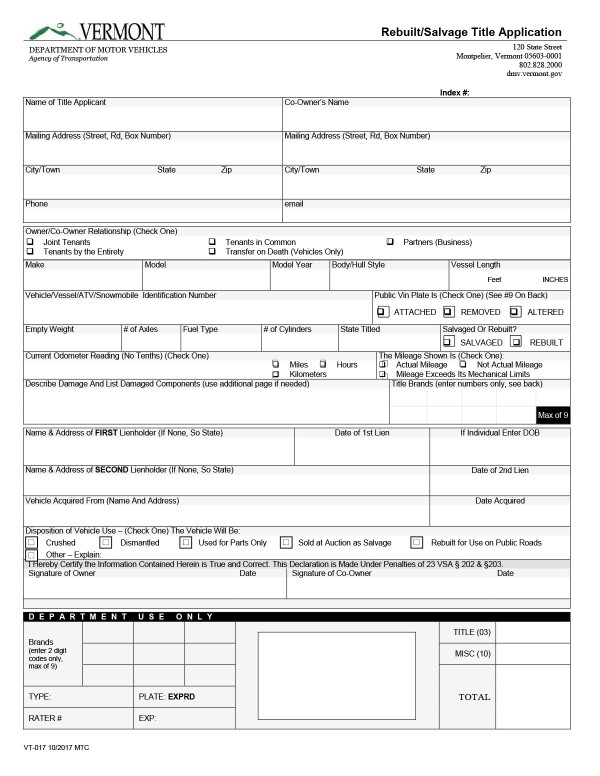

. This includes interest taxed at the federal level but exempted for Vermont income tax purposes and interest not taxed at the federal level. Check the box to the right of the box requesting Drivers License Number State to indicate that the taxpayer is. Registration Tax Title Form form VD-119.

File or Pay Online. New York City extends an exemption from the citys hotel occupancy tax based on New York State Form ST-1191. W-4VT Employees Withholding Allowance Certificate.

When filing Form IN-111 Vermont Income Tax Return include the name and information of the deceased taxpayer or deceased spousecivil union on the form if the taxpayer died during the tax year for which you are filing. VT Department of Tax. Therefore when a public school from Vermont makes purchases in Iowa the school would be subject to paying Iowa sales tax.

The Virginia income tax rate for tax year 2021 is progressive from a low of 2 to a high of 5. E-mail response 1152001. An original or a certified copy of a previous Vermont or out-of-state registration indicating the applicants ownership.

Monday - Friday except holidays 802-828-2386. Corporations Business Services. But economists agree that some portion of these taxes is shifted forward to others in the form of higher prices for consumers lower wages for workers reduced returns to shareholders or some combination of the.

See instructions Form IT-225-I. IN-111 Vermont Income Tax Return. PA-1 Special Power of Attorney.

Starting Your Business in Vermont. Printable Georgia state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. New York State Modifications Form IT-225 New York State Modifications Tax Year 2021 Department of Taxation and Finance New York State Modifications Attachment to Form IT-201 IT-203 IT-204 or IT-205 Names as shown on return IT-225 Identifying number as shown on return Complete all parts that apply to you.

Explore the latest state-local tax burden rankings with a new Tax Foundation study on state and local taxes. Printable Virginia state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. A previous Vermont or out-of-state title indicating the applicants ownership.

The applicant must furnish one of the following proofs of ownership in order of preference. You can check the status of your Virginia refund 24 hours a day 7 days a week using our Wheres My Refund tool or by calling our automated phone line at 8043672486. Virginia state income tax Form 760 must be postmarked by May 1 2022 in order to avoid penalties and late fees.

Iowa does not have sales tax reciprocity with the State of Vermont. The form is complete and signed. The Georgia income tax rate for tax year 2021 is progressive from a low of 1 to a high of 5.

Georgia state income tax Form 500 must be postmarked by April 18 2022 in order to avoid penalties and late fees. The federal income tax IRS 1040 form also lists AGI on Line 11 of the 2020 and 2021 form. State of Vermont Incentive Application Form.

A Vermont Government Website. 128 State Street Montpelier Vermont 05633-1101. An out-of-state dealer including a marketplace seller who is not registered for sales tax in any state eg home state does not levy sales tax may provide a Tennessee supplier with a fully completed Streamlined Sales and Use Tax Exemption Certificate that includes a tax ID number for another tax type eg business tax or excise tax.

Capitol Police Department 802 828-2229. 745 AM to 430 PM. Vermont State House 115 State Street Montpelier VT 05633-5301 802 828-2228 sgtatarmslegstatevtus.

VT Department of Labor. FY2023 Property Tax Rates. Certified Record Request.

Wheres my Virginia Refund. Understand and comply with their state tax obligations. Vermont State Curators Office Commissioners Office Dedicated to Providing Essential Services and Resources to Support our Government Partners Vermonters and Visitors.

Free Vermont Motor Vehicle Bill Of Sale Form Vt 005 Pdf Eforms

Filing Season Updates Department Of Taxes

Tax Form Templates 5 Free Examples Fill Customize Download

Personal Income Tax Department Of Taxes

Tax Form Templates 5 Free Examples Fill Customize Download

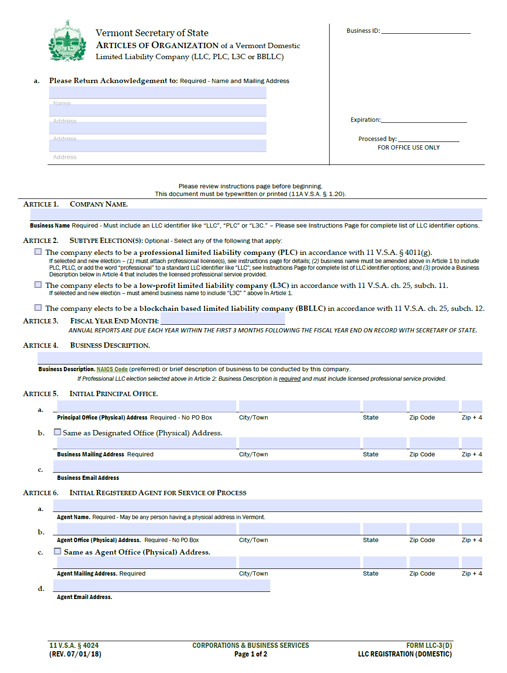

Vermont Llc How To Start An Llc In Vermont Truic

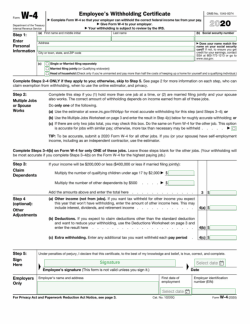

State W 4 Form Detailed Withholding Forms By State Chart

State Corporate Income Tax Rates And Brackets Tax Foundation

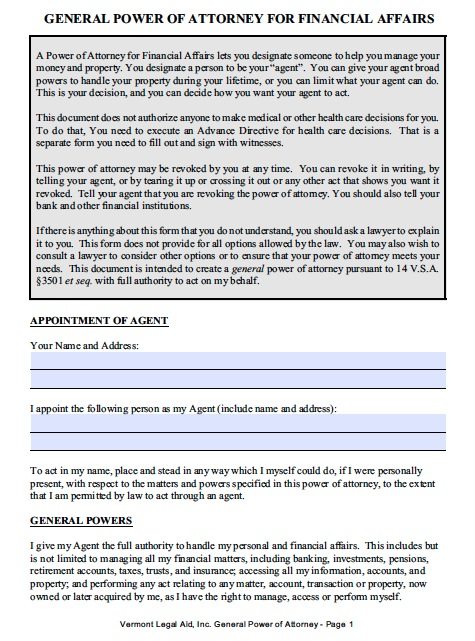

Free Vermont Power Of Attorney Forms Pdf Templates

Tax Form Templates 5 Free Examples Fill Customize Download

Vermont Bill Of Sale Only Registration Instructions Youtube

Tax Year 2021 Personal Income Tax Forms Department Of Taxes

What Is A W 9 Tax Form H R Block

About Bills Of Sale In Vermont Key Forms Information

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

The Differences Between Major Irs Tax Forms H R Block

Fillable Online State Vt Vermont Use Tax Return State Of Vermont State Vt Fax Email Print Pdffiller